Are you weighing your options for injection mold manufacturing and trying to balance cost, quality, and lead time? At Toolingsun, we understand that selecting the optimal production location—whether for high-volume runs or small-batch prototypes—is a critical decision for your bottom line and your brand’s reputation. In this post, we’ll take a deep dive into the key factors that drive mold-making costs, compare leading regions (China, Mexico, India, and Southeast Asia), and share how our turnkey approach ensures you get high-quality molds on time and within budget.

What Drives Injection Mold-Making Costs?

Before exploring global hubs, it’s essential to understand what contributes to your mold bill:

- Material Expenses

- Steel for molds: P20, H13, S136, and other tool steels vary in price based on grade, supply, and demand.

- Plastic resins: Nylon, ABS, polycarbonate, and specialty engineering plastics also influence cost per cycle.

- Machine Power & Efficiency

- High-tonnage presses and modern automation reduce cycle times and per-part costs—especially important for large-volume orders.

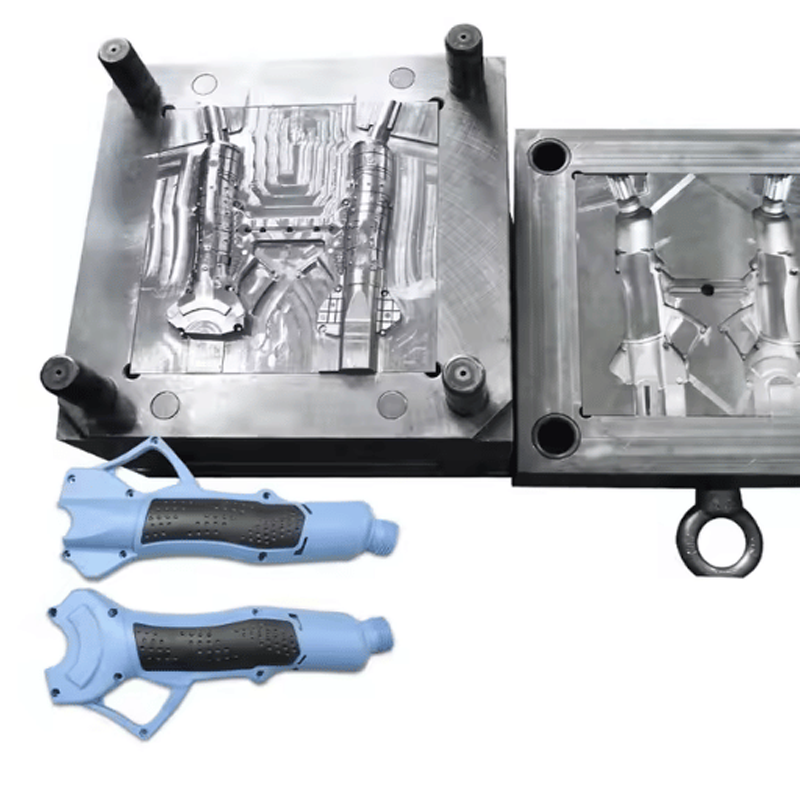

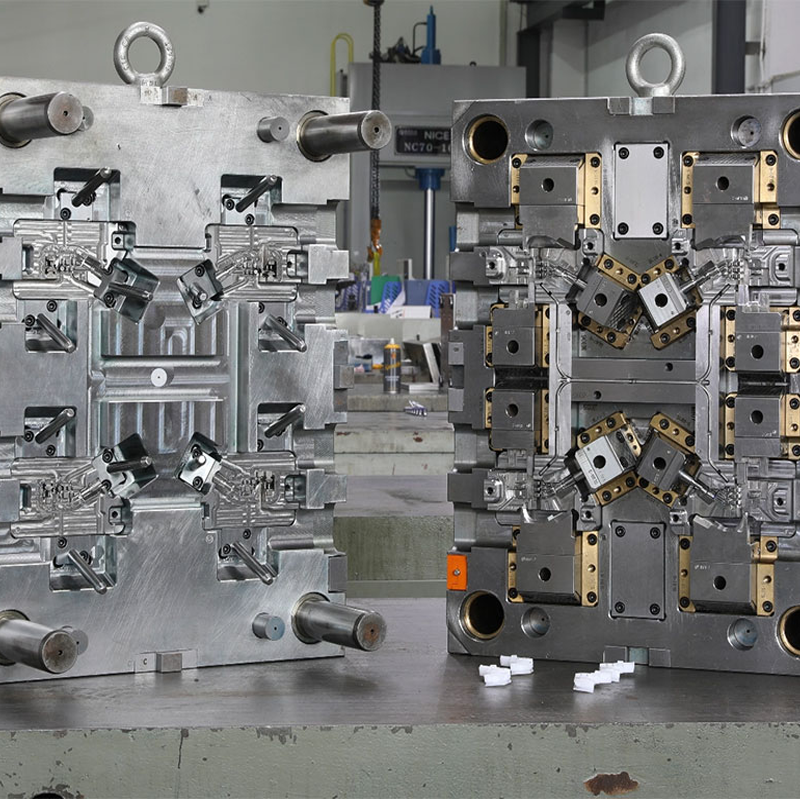

- Design Complexity

- Intricate features, undercuts, side actions, and tight tolerances all require more machining time, advanced EDM work, and skilled labor.

- Labor Rates

- Skilled toolmakers, CNC operators, and quality inspectors command different wage levels around the globe.

- Location & Logistics

- Proximity to your factory or end-markets affects shipping, import duties, and overall lead times.

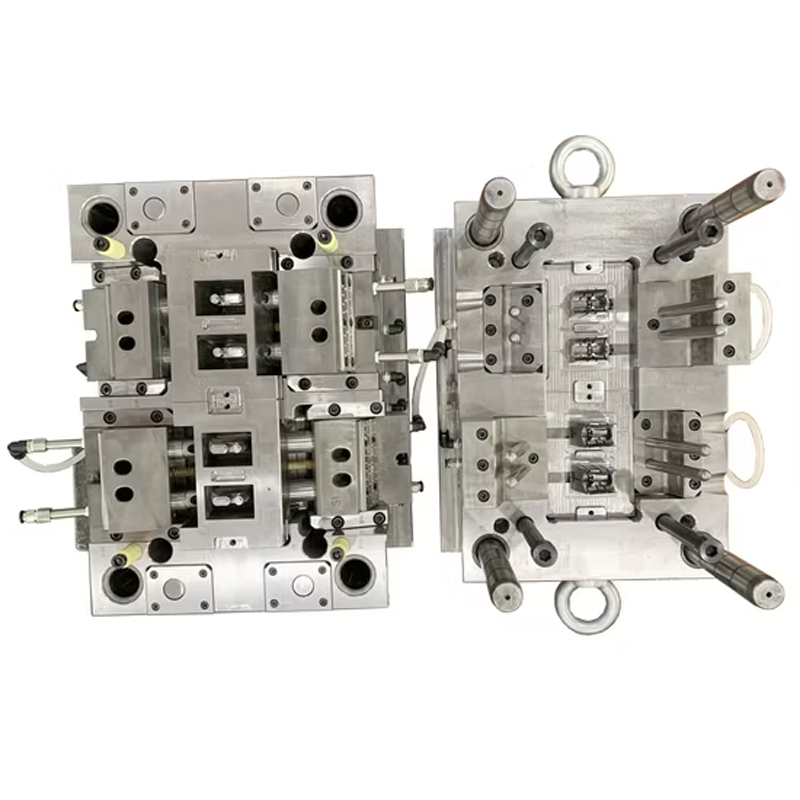

- Technology & Equipment

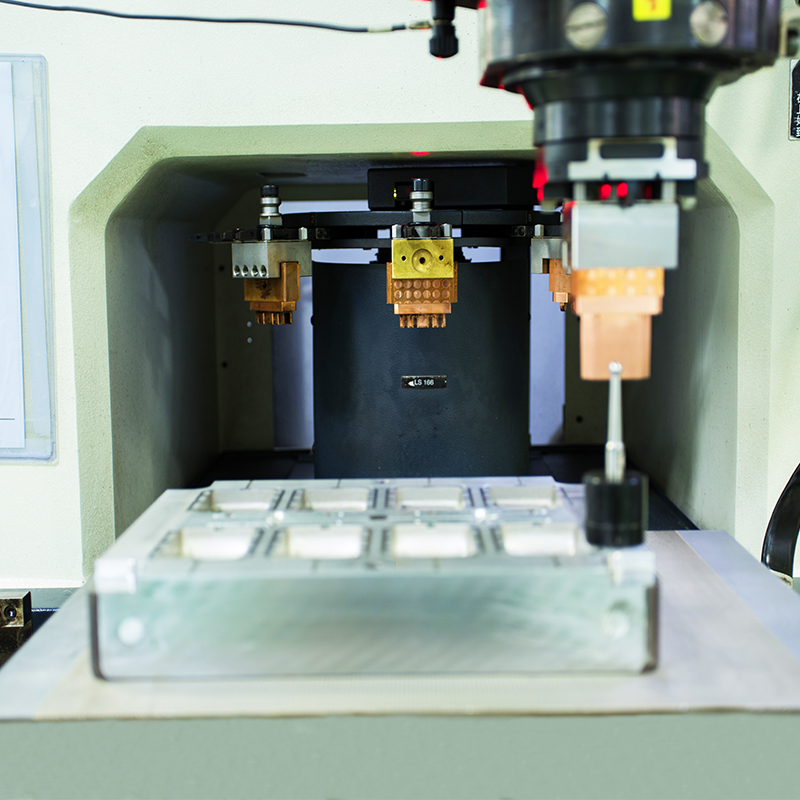

- State-of-the-art CNC, mirror EDM, and in-mold sensors boost precision but come with higher capital and maintenance costs.

Top Regions for Cost-Effective Molding Services

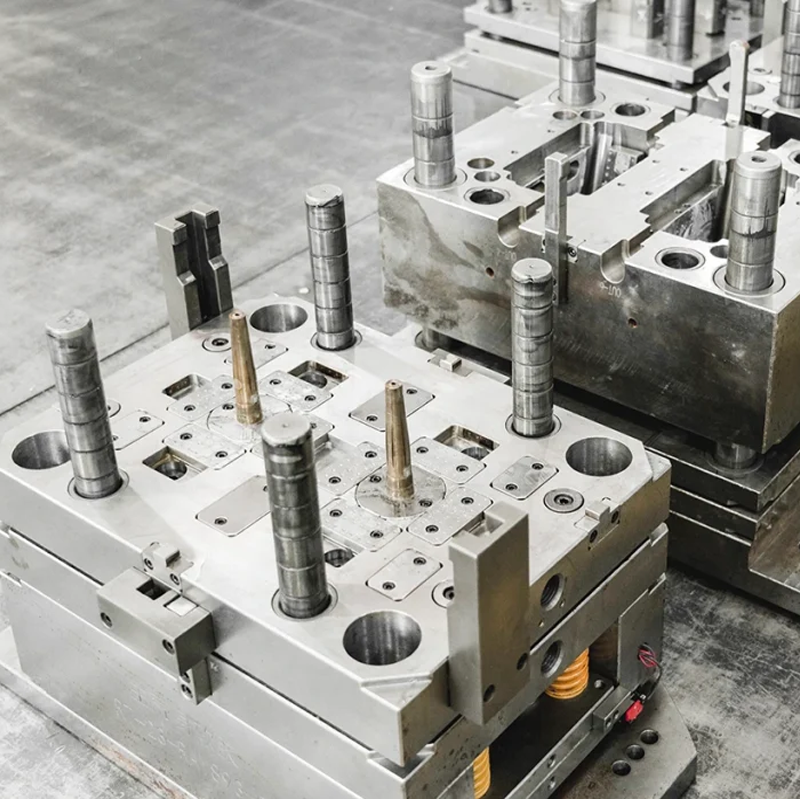

1. China: Scale, Speed, and Expertise

China remains the world’s largest mold-making hub, boasting over half a million tool shops and injection facilities.

- Pros:

- Competitive Pricing: 20–60% lower mold costs than North America or Western Europe, especially for high-volume runs.

- Massive Capacity: Capable of producing dozens—or hundreds—of molds simultaneously.

- Maturing Quality Control: Many Tier‑1 suppliers now adhere to ISO 9001 and IATF 16949 standards.

- Cons:

- Language & Cultural Gap: Miscommunications can cause delays unless you work with an experienced local partner.

- IP Protection: While NDAs are common, you must vet suppliers and consider joint-venture structures for sensitive designs.

Toolingsun’s Edge: We’ve built longstanding relationships with best-in-class Chinese tool shops and implement rigorous on-site oversight to safeguard your designs and ensure production consistency.

2. Mexico: Nearshoring for North America

For U.S. and Canadian companies, Mexico offers a strategic blend of lower labor costs and proximity.

- Pros:

- Lower Shipping Times & Costs: Trucks can deliver molds in 3–5 days versus weeks by sea.

- Favorable Trade Agreements: Under USMCA, many parts enter duty-free.

- Growing Technical Base: Modern clusters in Querétaro and Monterrey specialize in automotive and aerospace tooling.

- Cons:

- Labor Premiums Rising: Wages have been increasing as the industry matures.

- Capacity Limits: Mexico’s mold-making sector is growing fast, but cannot match China’s sheer volume for massive orders.

3. India: Cost Leaders and Emerging Quality

India’s “Make in India” initiative and Special Economic Zones (SEZs) have spurred rapid growth in mold-making.

- Pros:

- Low Labor Rates: One of the world’s most cost-effective skilled labor markets.

- Growing Technology Adoption: Many shops now use 5‑axis CNC and automated EDM, plus 3D-printed mold inserts for rapid prototypes.

- Cons:

- Infrastructure Gaps: Power stability and logistics can still be challenges in some regions.

- Quality Variation: Requires rigorous supplier qualification to ensure consistent standards.

4. Southeast Asia (Vietnam, Thailand, Indonesia): Rising Alternatives

Countries like Vietnam and Thailand are earning a reputation for rapid-growth manufacturing.

- Pros:

- Competitive Labor Costs: Often on par with India for injection molding wages.

- Regional Trade Pacts: ASEAN Free Trade Agreement (AFTA) reduces intra-regional duties.

- Expanding Infrastructure: New industrial parks with modern utilities.

- Cons:

- Quality Screening Required: Not all shops have the same precision or quality systems.

- Longer Shipping from Asia to the Americas: Still a consideration for urgent orders.

Toolingsun’s Edge: We perform thorough audits and pilot runs in Southeast Asia, integrating our SPC and in-line inspection processes to bring these emerging hubs up to our global standards.

Key Cost Comparisons

| Region | Mold Cost Index (vs. USA=100) | Typical Lead Time | Labor Rate (USD/hr) | Quality Certifications |

|---|---|---|---|---|

| USA/Canada | 100 | 4–8 weeks | $50–100 | ISO 9001, IATF 16949 |

| China | 40–60 | 4–6 weeks | $7–15 | ISO 9001, IATF 16949 |

| Mexico | 65–80 | 2–4 weeks | $15–25 | ISO 9001, IATF 16949 |

| India | 30–50 | 6–8 weeks | $5–12 | Varies; ISO 9001 common |

| Southeast Asia | 35–55 | 5–7 weeks | $8–18 | ISO 9001, limited IATF |

Data are illustrative averages; actual costs vary by complexity, volume, and supplier.

Making the Right Choice with Toolingsun

Choosing the right injection mold-making partner is more than a simple cost comparison. You need:

- Transparent Communication: Clear requirements, rapid feedback loops, and fluent project management.

- Proven Quality Systems: SPC, PPAP, and in-line inspection to catch deviations early.

- IP and Confidentiality Safeguards: NDAs, on-site audits, and secure data handling.

- End-to-End Support: From DFM reviews and rapid prototyping to full-scale production and after-sales service.

Ready to explore how we can optimize your injection mold-making? Get in touch with Toolingsun today for a personalized cost-benefit analysis and start saving on your next molding project without sacrificing quality.